espp tax calculator india

On etrade we have option to sell only ESPP or only RSU. With an immediate sale of your ESPP shares at purchase the discount is reported on your W-2 and.

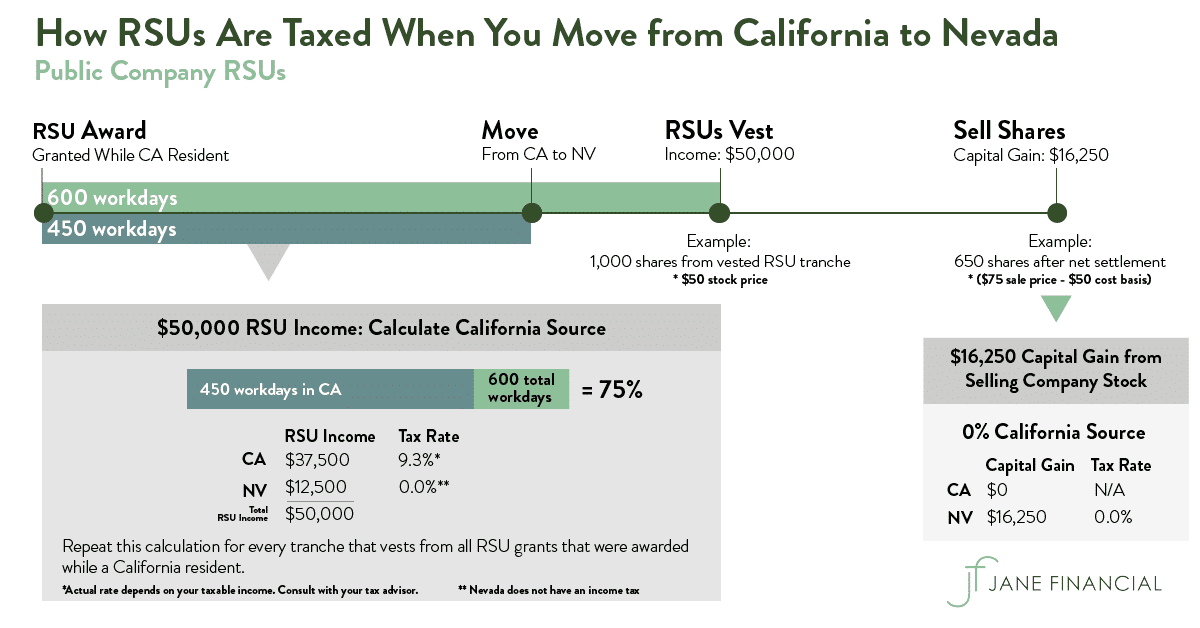

Restricted Stock Units Jane Financial

The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all.

. The ESPP tax rules require you to pay ordinary income tax on the lesser of. Wil i be taxed on FIFO basis or only on ESPP. Using the ESPP Tax and Return Calculator.

Employee Stock Purchase Plan ESPP Calculator. An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at. Companies give ESOPs in parts there is a vesting schedule.

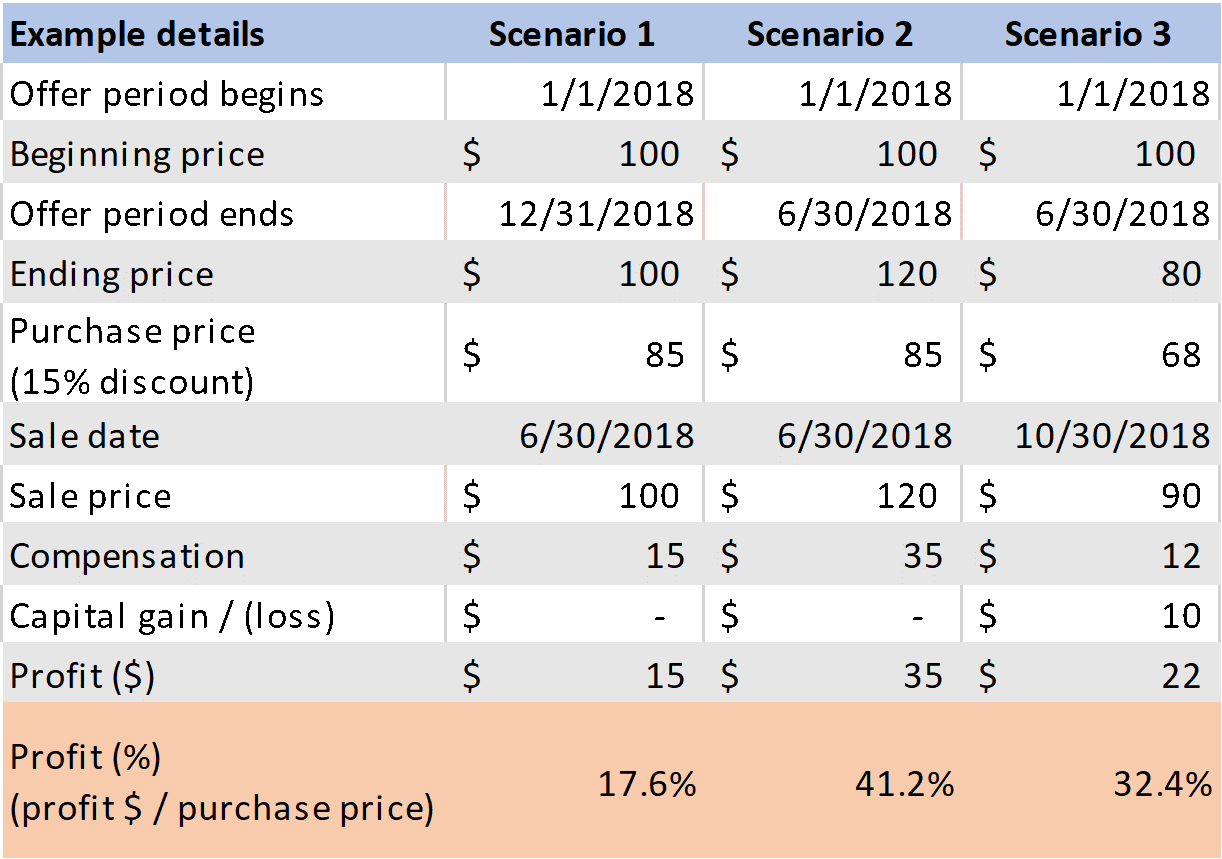

The Employee Stock Purchase Plan ESPP provided by many publicly traded companies is a great benefit but the benefit calculation is not simple if you are not familiar with. In most cases the discount you received will be reported as ordinary income in. 10003 Restricted Stock Units 10003 Stocks listed on Foreign Stock Exchanges.

For buying you will be additionally taxed only for 15 discount rate you get in espp from market price. What is an ESPP ESOP. Youll recognize the income and pay tax on it when you sell the stock.

Not filing Form 8949 after an immediate sale of ESPP shares at purchase. So today an employee may get 3000 shares which would be given in sets of 1000. The discount offered based on the offering date price or.

An employee stock purchase plan ESPP is a company-run program in which participating employees can purchase company stock at a discounted price. Employee Stock Options are equity shares granted to valued employees of an organisation on the fulfillment of certain milestones set by the. Learn more about meaning and taxation of RSU ESOP ESPP.

Answer 1 of 4. ESOPs would be taxed as perquisite the value of which would be on date of allotment FMV per share Exercise price per share x number of shares allotted. When I sell my ESPP.

You are buying ESPP from your post tax money. The majority of publicly. When you buy stock under an employee stock purchase plan ESPP the income isnt taxable at the time you buy it.

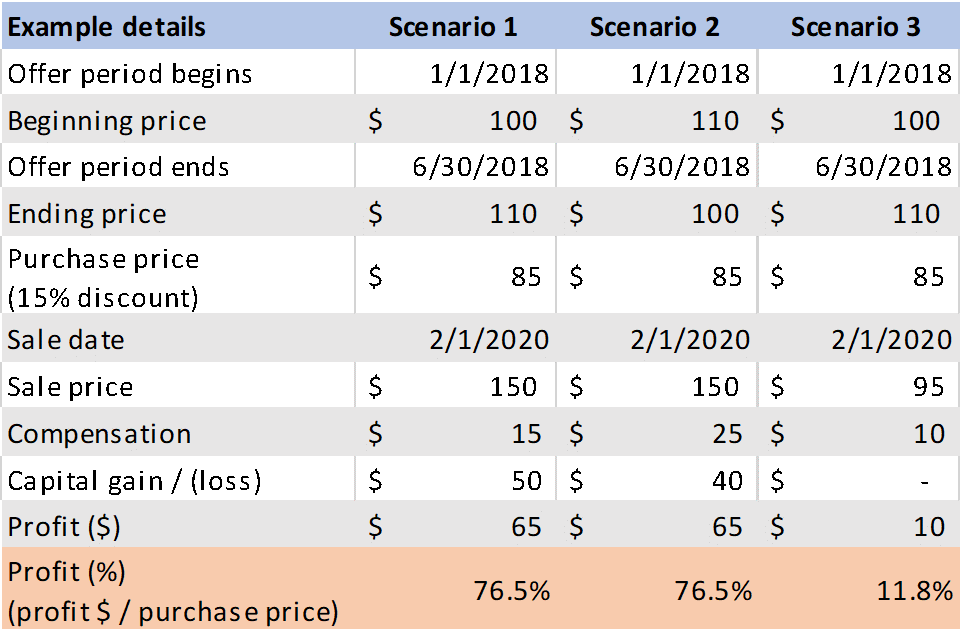

ESPP Basis current About. 20 ESPP shares vested on 1 Jan 2017 20. This calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription.

ESOPs also help in retaining employees. Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming. The gain calculated using the actual purchase price and.

How You Can Benefit From A Down Market Using An Employer Stock Purchase Plan Plancorp

/Investopedia_EmployeeStockPurchasePanESPP_Final-41c7a310275f4bb5912cf912acdd98ca.jpg)

Employee Stock Purchase Plan Espp

Salary Payroll Tax And 401k Calculators Adp

Should I Even Bother Contributing To My Company S Espp Rivermark Wealth Management Certified Financial Planner

When To Sell Espp Shares For Tax Benefits

4 Factors To Consider Before Participating In Your Espp

Restricted Stock Units Jane Financial

Small Business Tax Planning Carta

Employee Stock Purchase Plans Turbotax Tax Tips Videos

How To Report 2021 Espp Sale In Turbotax Don T Pay Tax Twice

Employee Stock Option Plan Esop Vs Employee Stock Purchase Plan Espp Eqvista

Employee Stock Purchase Plans Espp Are You Making The Most Of Yours Hudson Oak Wealth Advisory

Employee Stock Purchase Plans Espps Understanding And Maximizing A Great Employer Benefit You May Be Missing Out On Sensible Financial Planning

Employee Stock Purchase Plans Espps Understanding And Maximizing A Great Employer Benefit You May Be Missing Out On Sensible Financial Planning

Rsu Taxes Explained 4 Tax Strategies For 2022

When Should You Sell Espp Shares Equity Ftw

:max_bytes(150000):strip_icc():gifv()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)